Band Reversal Intraday Strategy

Introduction

The Band Reversal Intraday Strategy is a meticulously designed trading approach by TradingKernel.com that capitalizes on oversold market conditions to identify potential bullish reversals.

Note: All Trading Kernel Strategies should not be traded at the open or close of the day due to high spreads.

Strategy Overview

- Strategy Name: Band Reversal Intraday Strategy

- Strategy Type: Pattern Trading

- Strategy Security: Forex – BTCUSD, ETHUSD

- Timeframe: 1 Hour

- Date of Test: 2023-01-01 to 2024-12-01

Indicators or Key Parameters Used

- OHLCV Data: Core data used for technical analysis.

- Bollinger Bands: Close below the lower band indicates oversold conditions.

- RSI (Relative Strength Index): RSI below X signals potential oversold conditions.

- Candlestick Analysis: A bearish close provides confirmation of momentum – Version 1

- Candlestick Analysis: The Upper Wick is greater the Y times the Lower Wick

Fact Discovered from Strategy

During the testing period, when the defined conditions occurred, there was a probability slightly greater than 60% that the next candle would be bullish. This statistical edge forms the basis of the strategy’s predictive capability.

This pattern also showed some promising results only across crypto based assets, this does not generally mean that every strategy that is profitable on BTCUSD, would also be profitable on other crypto assets, but it shows a relationship that proves to some extent, that crypto currencies move slightly in the same way, and if a strategy is profitable on a crypto based asset, you should rather proceed with your research on crypto based assets that moving to forex or stocks.

Taking this into account, further tests can be carried out in the future!

Strategy Implementation and Explanation

The Band Reversal Intraday Strategy uses a combination of Bollinger Bands, RSI, and candlestick momentum to identify high-probability buy opportunities:

There are 2 versions of the strategy, for version one, conditions 1, 2, 3 are used, for version 2, conditions 1, 2, 4 are used.

- Condition 1: The closing price falls below the Bollinger Band’s lower band, signaling an oversold market.

- Condition 2: RSI is less than X, confirming oversold momentum.

- Condition 3: The candle closes bearish, indicating ongoing selling pressure. for version 1

- Condition 4: The Upper Wick is greater than Y times the lower wick, for version 2

- Buy Signal: When all conditions are met simultaneously, the strategy opens a buy position at the open of the next candle and closes that position at the open of the candle after.

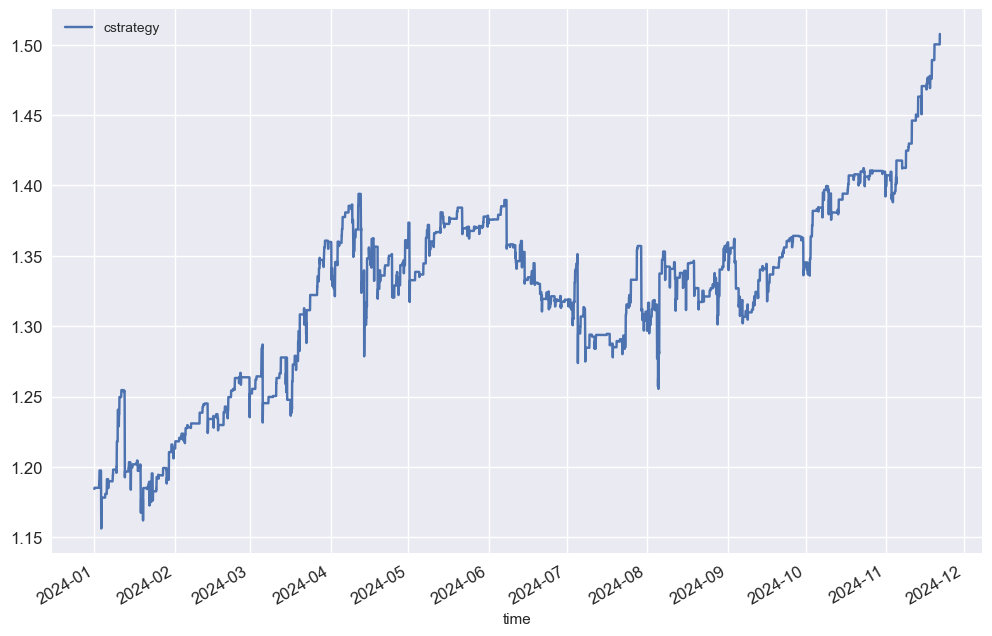

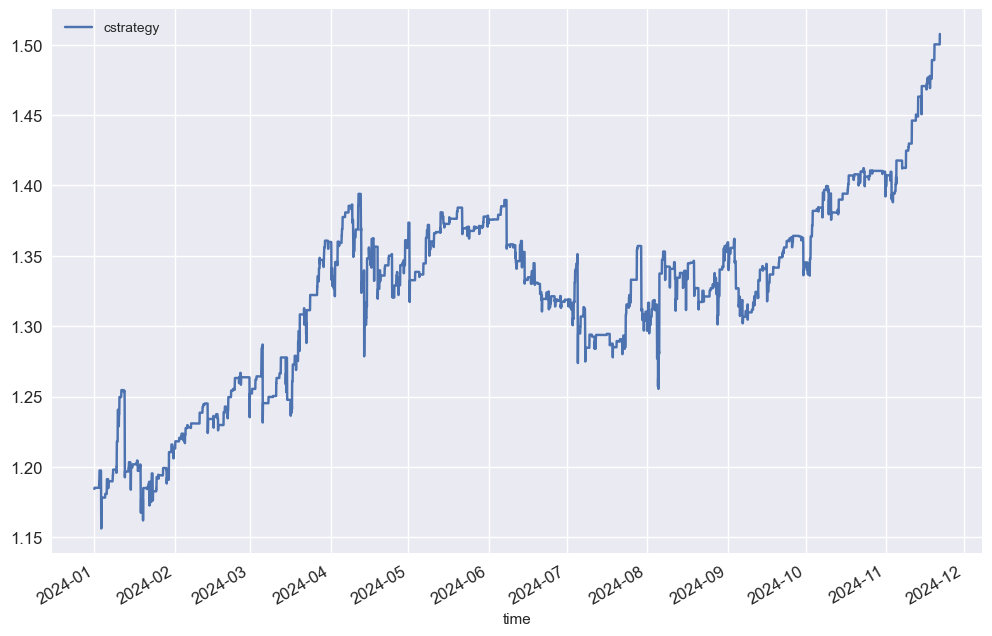

Strategy Overall Performance

Strategy vs. Returns Performance Analysis:

| Metric | Value |

|---|---|

| Cumulative Returns | 5.745988661619382 |

| Cumulative Strategy | 1.5076672942164309 |

| Out/Under Performance | -4.238321367402952 |

Overall Performance Metrics:

| Metric | Value |

| CAGR | 0.242755 |

| Annualized Mean | 0.217344 |

| Annualized Std | 0.187951 |

| Sharpe Ratio | 1.291588 |

| Sortino Ratio | 1.529264 |

| Maximum DrawDown | 0.116291 |

| Calmar Ratio | 2.08749 |

| Max Drawdown Duration | 178 |

| Kelly Criterion | 6.690254 |

Risk Management

- Define Risk: Analyze the historical maximum drawdown (11.63% – Non Leveraged!!) to configure an appropriate lot size.

- Position Sizing: Use the Kelly Criterion for optimal allocation (6.69% of capital).

Backtesting and Optimization

- Frameworks: Backtesting was conducted using the Shreya Framework on MT5 and DxTrade platforms.

- Optimization: Parameters such as RSI threshold and Bollinger Bands settings can be fine-tuned based on historical volatility. the close condition can also be modified, to see if there are improvements.

Strategy Resource Files

TradingKernel.com provides all necessary resources for seamless implementation:

- Python File (.py): Automates the strategy on the Shreya Framework.

- MT5 Indicator: Ready-to-use indicator for MetaTrader 5.

- TradingView Indicator: Visual representation for manual traders.

- Financial Analysis: Detailed Jupyter Notebook report for further insights.

👉 Download the Strategy Files Here for in-depth performance analysis, insights, and implementation details.