Wick Momentum Reversal Strategy – Master precision trading with this advanced pattern-based strategy for AUDJPY (1-Hour Timeframe).

✔ Proven profitability with a Sharpe Ratio of 2.80

✔ Optimized for Shreya Framework (MT5 & DxTrade)

✔ Over 60% bullish probability in tested patterns

✔ Includes Python script, MT5 indicator, TradingView template, and Jupyter Notebook

Wick Momentum Reversal Strategy Files

100.00$ Original price was: 100.00$.24.99$Current price is: 24.99$.

Need help or got any questions?

Out of stock

Wick Momentum Reversal Strategy – Turn Market Patterns into Profits

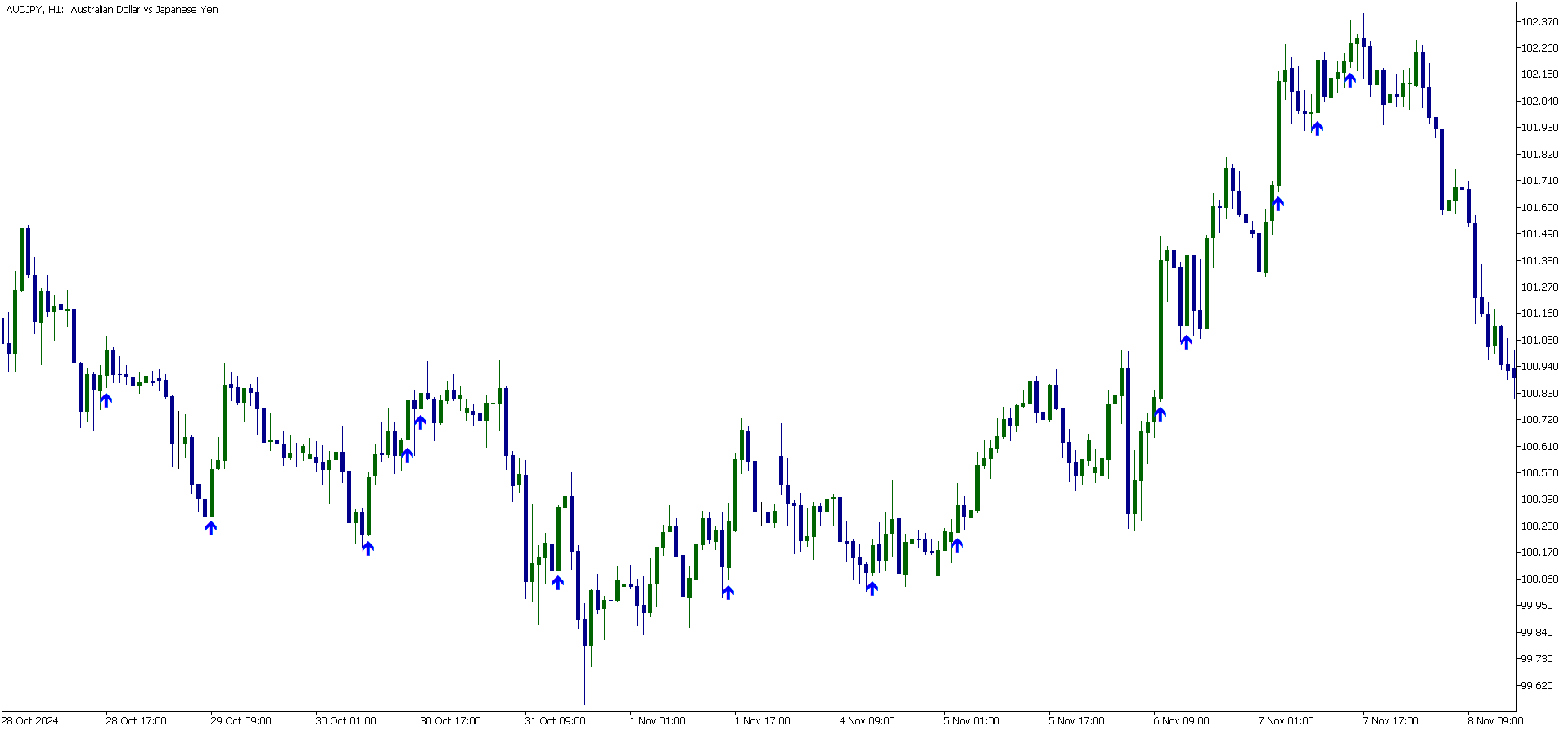

Unleash the power of data-driven trading with the Wick Momentum Reversal Strategy, an exclusive creation by TradingKernel.com. Tailored for AUDJPY on a 1-hour timeframe, this strategy empowers traders to identify high-probability bullish reversals based on candlestick patterns.

This strategy isn’t just theory—it’s tested rigorously across nearly 2 years of historical data, delivering consistent and reliable results for forex traders aiming to take their performance to the next level.

Key Features

- Proven Pattern-Based Trading

- Detects precise candlestick conditions with a probability of over 60% for bullish outcomes.

- Avoids market noise and false signals with robust criteria.

- Comprehensive Tools and Files

- Python script for integration with Shreya Framework.

- Ready-to-use MT5 and TradingView indicators for seamless trading.

- Jupyter Notebook for financial analysis and customization.

- Risk Management Included

- Detailed guidelines on configuring lot size and managing drawdowns effectively.

- Risk-reward balanced for steady portfolio growth.

- Optimized Backtesting

- Fully tested with a Sharpe Ratio of 2.80, Sortino Ratio of 4.48, and Calmar Ratio of 3.10.

- Maximum drawdown of just 2.67% ensures capital preservation.

Performance Highlights

The strategy boasts impressive performance metrics, ensuring confidence in every trade:

- CAGR: 8.28%

- Maximum Drawdown Duration: 66 Hours

- Kelly Criterion: 91.40% for optimal position sizing

These results make the Wick Momentum Reversal Strategy a standout choice for traders seeking precision, reliability, and profitability.

What You’ll Get

- Python Script: Seamlessly integrate and automate trades.

- MT5 Indicator: Gain edge with visual pattern detection on MetaTrader 5.

- TradingView Indicator: Enjoy advanced charting and flexibility.

- Jupyter Notebook: Dive deep into the analytics and modify parameters to suit your needs.

With all these resources, you’re equipped to trade confidently from day one.

FAQ (Frequently Asked Questions)

1. Who is this strategy for?

This strategy is designed for forex traders who want a reliable, tested, and data-driven approach to trading the AUDJPY pair on a 1-hour timeframe.

2. Can I use this on other currency pairs or timeframes?

The strategy is optimized for AUDJPY (1-hour timeframe). While it can theoretically be adapted, we recommend following the tested setup for maximum reliability.

3. What platforms are supported?

The strategy can be implemented on MT5, DxTrade, and TradingView. It also includes a Python script for use with the Shreya Framework.

4. Is this strategy beginner-friendly?

Yes! With the included tools and clear guidelines, even beginner traders can implement it easily.

5. Does it include risk management guidance?

Absolutely. The strategy comes with detailed instructions on lot sizing and managing drawdowns for optimal risk control.

6. How do I access the included files?

Once purchased, you’ll receive immediate access to all resource files, including the Python script, indicators, and analysis notebook.

You must be logged in to post a review.

RELATED PRODUCTS

Advanced Supply Demand

Market Reversal Alerts Indicator and EA

MT5 to DxTrade Copier

Owl Smart Levels

Trend Screener Pro

Introducing the Trend Screener Pro – the advanced MT5-integrated tool for real-time trend detection, correlation analysis, and AI-driven insights. Designed for forex traders, this all-in-one screener scans multiple timeframes, identifies support/resistance zones, and generates smart trade ideas using AI to boost your edge in volatile markets.

Reviews

There are no reviews yet.