Market Reversal Alerts Indicator and EA is now available on Trading Kernel, for only 24.99$, EA Included! Instant and lifetime download, the files should be extracted and the indicator copied to your MQL4/Indicators directory, after which you load any or all to your chart.

Platform: MT4

Currency Pairs: All

Trading Time: All.

Market structure shifts (reversals)

No repainting Indicator

Market Reversal Alerts Indicator and EA

25.00$

Need help or got any questions?

Unlock the power of market structure changes with our Market Reversal Alerts Indicator. It’s your key to identifying trend reversals and pullbacks, helping you profit from shifts in market dynamics.

Key Features:

- Market Structure Reversal Alerts: This indicator excels at recognizing when a trend or price movement is nearing exhaustion and is poised for a reversal. It keeps you informed about market structure changes that frequently precede reversals or significant pullbacks.

- Exhaustion Point Identification: The indicator initially identifies breakouts and price momentum each time a new high or low forms near a possible exhaustion point. It marks this with a rectangle on the last opposite-colored candle. As price continues in its current short-term trend, the rectangle follows, offering entry insights. When price eventually closes back above or below the rectangle, it signals a potential market structure shift and a likely reversal or significant pullback.

Key Features Continued:

- Versatile Alerts: This indicator boasts integrated pop-up, push, and email alerts, ensuring you never miss a potential reversal signal.

- Multiple Timeframes: It allows you to view higher timeframe reversal rectangles on your lower trading timeframe. This is particularly beneficial for trend traders and those seeking higher timeframe trend direction insights.

- Directional Alerts: Customize your alerts based on each pair’s current trend direction, allowing you to focus on specific trading opportunities.

Trading Strategy with the Market Structure Reversal Indicator:

When a reversal alert emerges:

- Identify Key Levels: Always consider support/resistance or supply/demand levels when a reversal alert triggers. Market structure shifts typically coincide with retests of these levels, or after stop hunts near them.

- Higher Timeframe Validation: Check the higher timeframe for significant support/resistance areas. As noted, market structure changes often materialize on lower timeframes when major levels on a higher timeframe are involved.

- Enter Trades: If the above conditions align, place a trade in the direction of the reversal. Add extra indicators or use this indicator to reinforce your existing strategy.

Risk Management:

Set your stop just above the most recent high or below the most recent low. For effective risk management, the size of your stop depends on the aggressiveness of the last move to create the recent high/low.

Take profit is customizable, but aiming for a 1.5:1 or 2:1 risk-to-reward ratio is realistic. Implementing trailing stops just above/below new rectangles can help achieve 5:1 or higher risk-to-reward ratios.

Don’t miss the opportunity to enhance your trading strategy with the Market Reversal Alerts Indicator. Start maximizing your profits today!

Markets Reversal Alerts EA

Experience the power of market structure shifts with our Markets Reversal Alerts EA. This expert advisor is designed to harness the potential of our Market Reversal Alerts Indicator, making it a seamless part of your trading strategy.

Key Features:

- Automatic Trading: The EA operates by taking trades each time it receives a market reversal alert from the indicator. It adheres to your predefined conditions and filters in the EA settings.

- Support Rectangle Formation: It creates support rectangles as price progresses in its current trend direction. The EA acts when price exhibits sharp reversals, signaling either a market structure shift or a retest of the reversal.

- Configurability: This EA offers immense power and configurability. You can use it with stop losses or employ grid or basket trading strategies. The expert advisor is highly versatile and open to customizations based on your preferences and style.

Specialized Trading Approach: Position Trading

The Markets Reversal Alerts EA is tailored for position trading. This style involves gradually entering market swings based on price movements and profit-taking actions by major banks that influence and manipulate prices. The set files included with this EA aim to generate returns of 5-10% per month in a typical trading month. Position trading is a long-term approach that focuses on swing trading.

To understand position trading better, you can access the free Position Trading Bootcamp course on YouTube. This EA enables you to incorporate position trading techniques effectively into your strategy.

Advanced Filtering Options:

The EA provides filtering capabilities for your entries. You can apply filters based on RSI, higher timeframe RSI, moving averages, higher timeframe moving averages, and ADR (Average Daily Range). You can also configure it to execute trades on reversal alerts triggered by sweep events of yesterday’s highs or lows (stop hunts). The options are limitless, and you can customize the EA to align with your unique trading style, making it an ideal tool for implementing smart money concepts.

Risk Management and Profit Taking:

The EA comes equipped with a range of trailing stop and profit-taking features. These features empower you to manage risk effectively and exit your positions in accordance with various parameters, including your account equity, ADR movements, and traditional pip changes.

Don’t miss the opportunity to supercharge your trading strategy with the Markets Reversal Alerts EA. Start harnessing the power of market structure shifts today!

Disclaimer: Please conduct thorough research and back testing before implementing this EA in your live trading.

You must be logged in to post a review.

RELATED PRODUCTS

Advanced Supply Demand

Advanced Supply Demand Indicator

Auto Order Block with Break of Structure

Owl Smart Levels

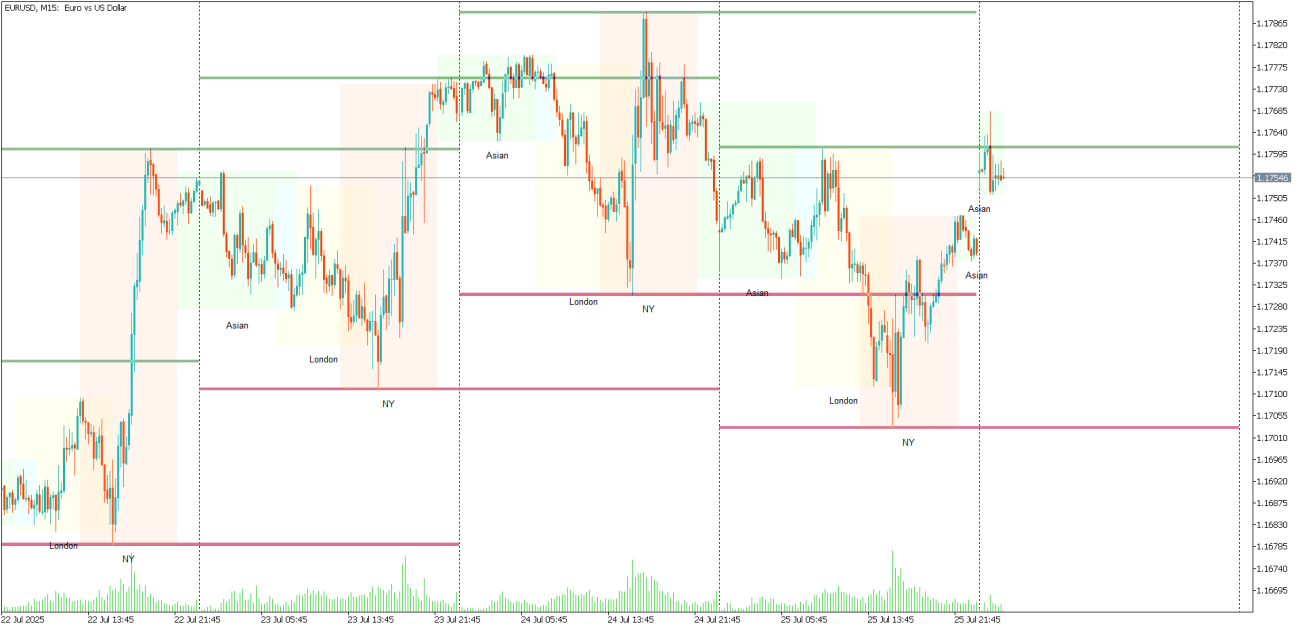

Range Liquidity Indicator for MT5

Unlock the power of liquidity trading with the Range Liquidity Indicator for MT5, now available on Tradingkernel.com for just $99! This advanced tool visualizes high/low ranges and key trading sessions (Asian, London, NY) over the past 7 days, with customizable colors, spacing, and chart templates. Perfect for intraday traders, it highlights support/resistance zones and session highs/lows with black labels for clarity. Download now and elevate your trading strategy with real-time insights!

Reviews

There are no reviews yet.