Wick Momentum Reversal Strategy

Introduction

The Wick Momentum Reversal Strategy is a pattern-based trading strategy developed exclusively by TradingKernel.com. This strategy focuses on identifying precise momentum reversal patterns in the forex pair AUDJPY on a 1-hour timeframe.

Note: Trading Kernel strategies are optimized to avoid trading at the open or close of the trading day due to high spreads. This ensures better trade execution and reduced trading costs.

Strategy Overview

- Strategy Type: Pattern Trading

- Security: Forex Pair (AUDJPY)

- Timeframe: 1 Hour

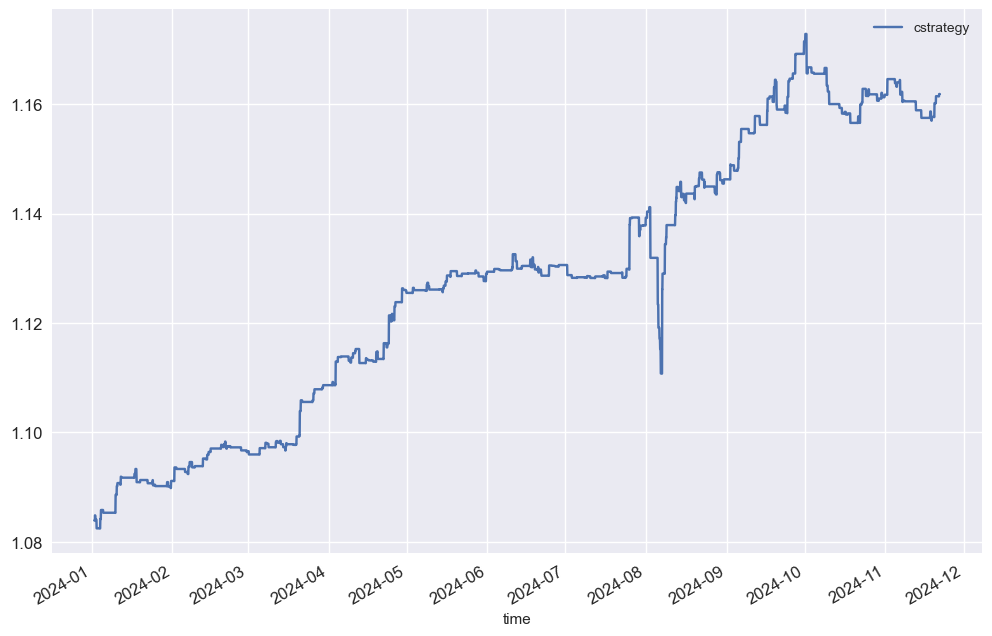

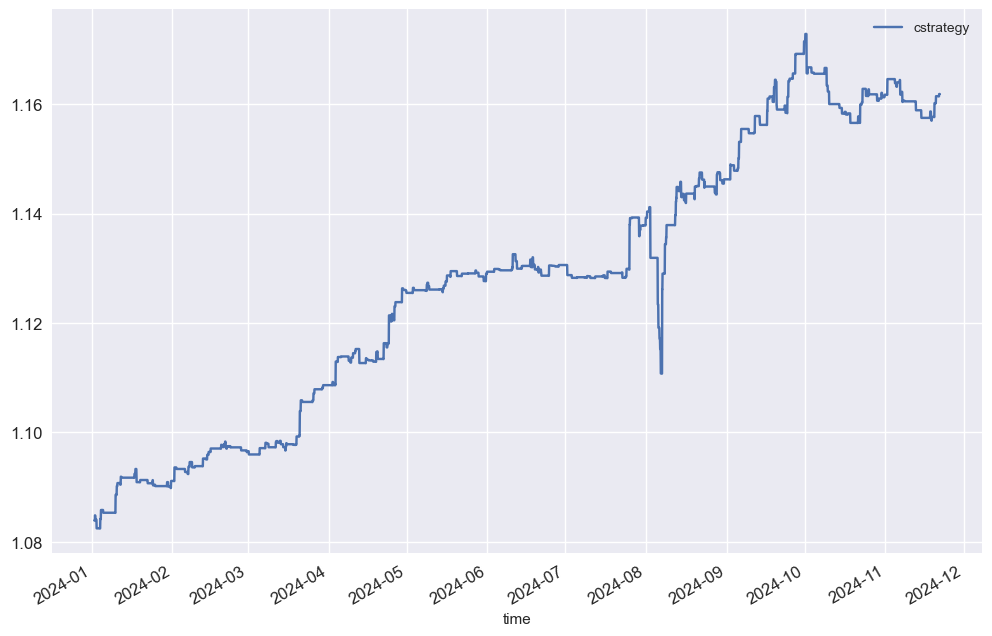

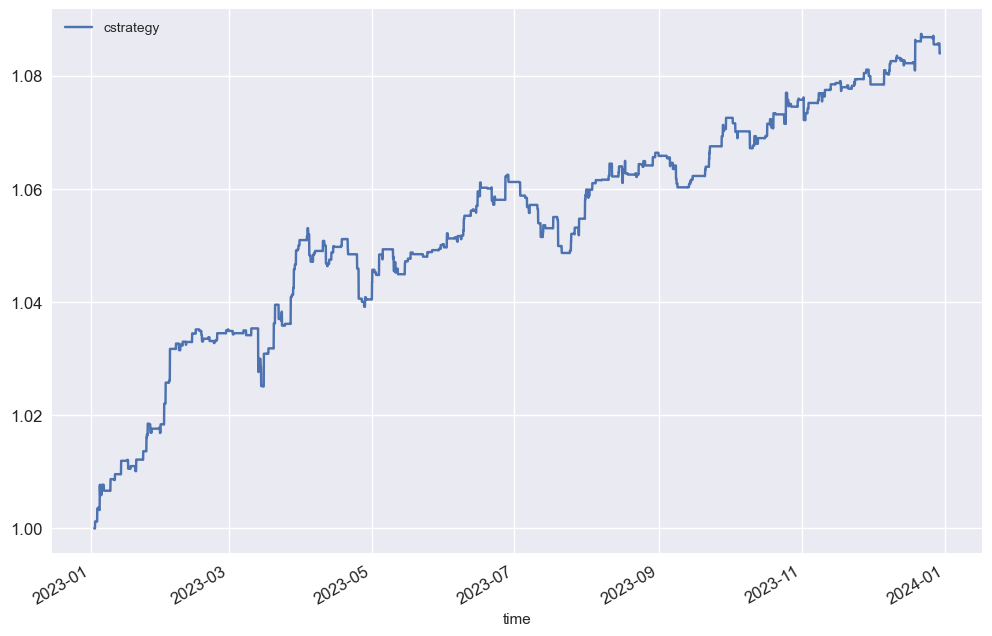

- Testing Period: January 1, 2023 – October 1, 2024

- Position Frequency: 1.3 Trades Per Day

This strategy leverages the relationship between wicks, candlestick body length, and price movement to identify bullish momentum in AUDJPY.

Indicators and Key Parameters Used

- OHLCV Data: The foundation of the analysis is built upon Open, High, Low, Close, and Volume (OHLCV) data.

- Candlestick Attributes:

- Upper and lower wicks are key determinants of price reversal signals.

- Candlestick body length is analyzed to detect momentum strength.

- Time Constraints: The strategy avoids signals during market close (after 22:00) and open hours (before 01:00).

Fact Discovered

During the back testing period, the strategy consistently identified that when the pattern below occurred, the probability of the next candle being bullish exceeded 60%.

The pattern is characterized by:

- A longer upper wick than the lower wick.

- A prior candlestick showing an opposite relationship (shorter upper wick than lower wick).

- An increasing candlestick body length, signaling strengthening momentum.

- A closing price higher than the opening price.

Strategy Implementation and Explanation

The Wick Momentum Reversal Strategy is designed to enter long trades under specific market conditions:

- A bullish candle appears with a longer upper wick compared to the lower wick, following a bearish candle where the opposite is true.

- The body length of the bullish candle is greater than its predecessor, indicating growing strength in price movement.

- The bullish candle closes above its opening price, confirming momentum.

- Trades are initiated only during active trading hours (01:00 – 22:00) to avoid high-spread periods.

This meticulous selection of conditions minimizes false signals and enhances overall profitability.

Strategy Overall Performance

The backtesting results highlight the robustness of the strategy:

| Metric | Value |

|---|---|

| CAGR | 8.28% |

| Annualized Mean | 7.95% |

| Annualized Std Dev | 2.96% |

| Sharpe Ratio | 2.80 |

| Sortino Ratio | 4.48 |

| Maximum Drawdown | 2.67% |

| Calmar Ratio | 3.10 |

| Maximum Drawdown Duration | 66 Hours |

| Kelly Criterion | 91.40% |

These metrics demonstrate consistent performance with minimal drawdowns, making it suitable for traders seeking steady growth with manageable risk.

Risk Management

Proper risk management is crucial to effectively utilize this strategy:

- Max Drawdown Analysis: Based on a historical maximum drawdown of 2.67%, traders should configure position sizing and leverage to prevent significant portfolio impact.

- Lot Size Calculation: Use the Kelly Criterion (91.40%) to adjust lot sizes, ensuring optimal risk-reward balance.

- Stop Loss Placement: You can use the maximum negative returns on the Shreya framework to calculate your stop loss levels depending on your lot size.

Backtesting and Optimization

Very little to no optimization was done on the Wick Momentum Reversal Strategy, as to avoid overfitting, and was built around the fact seen above, Therefore we simply discovered that when the said pattern occurs, the scenarios with positive returns are just enough to cover for the scenarios with negative returns and the cumulative trading costs.

Strategy Resource Files

To implement the Wick Momentum Reversal Strategy, Trading Kernel provides the following resources

- Python Script: For seamless integration into the Shreya Framework.

- MT5 Indicator: Optimized for MetaTrader 5 users.

- TradingView Indicator: For advanced charting and analysis.

- Financial Analysis Notebook File: Detailed Jupyter Notebook for confirmation, modifications or further customization.